FAQs

Click on the heading under the Expand All arrow below to read our useful guides and FAQs

The Essentials

Learner

Car Sharing

Business Use

MID

Claims

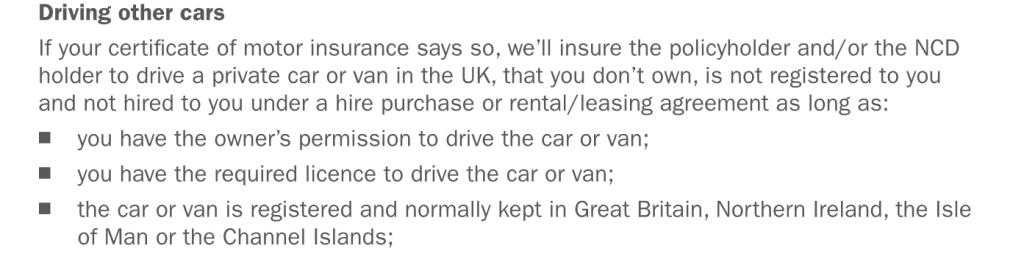

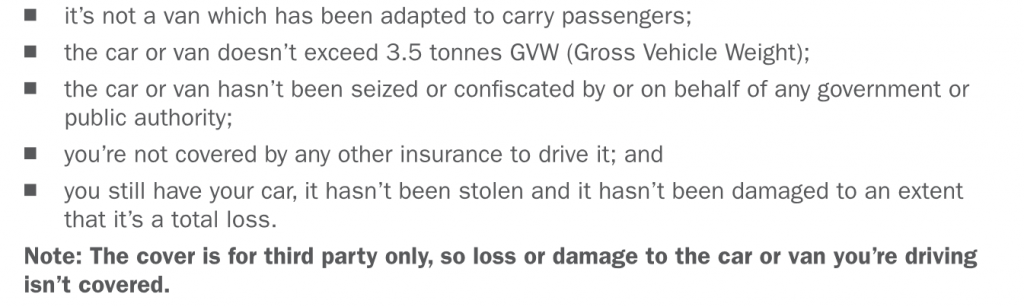

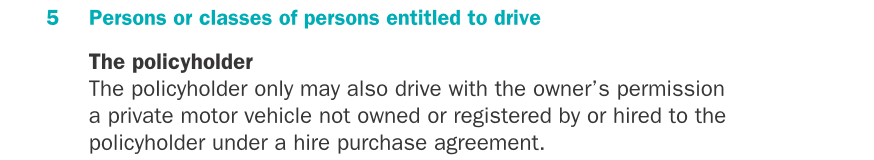

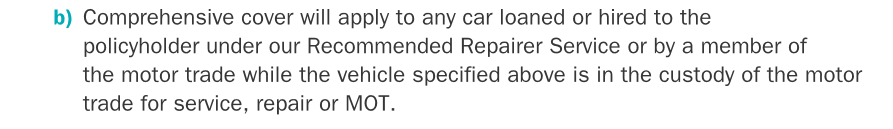

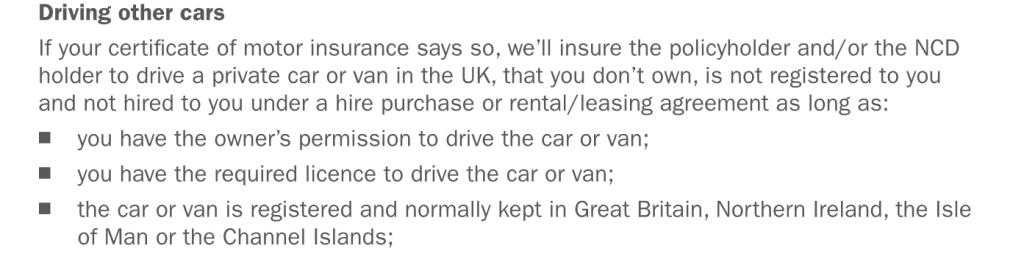

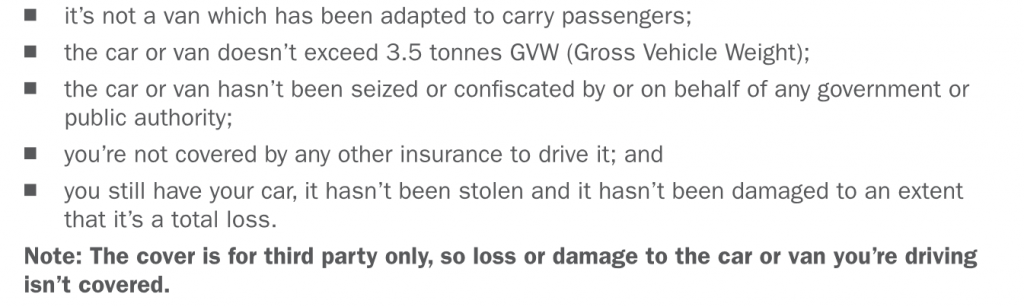

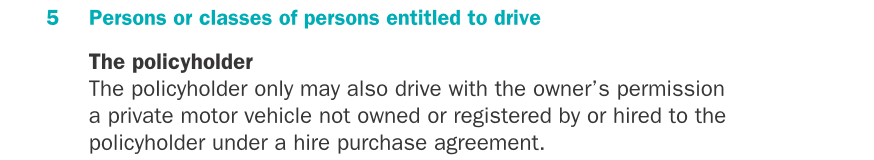

Please see the Learner section above for full details. In a nutshell you can take out short-term cover in your own name whilst you drive, or you can arrange to be added as a Named Driver to the annual insurance on the vehicle. NO! Insurers will always add restrictions/caveats to the DOC cover they provide – it’s not designed to cover a Bugatti Veyron! As well as the Insurance Certificate, there are 3 other places you can look to see what cover is being provided under the DOC extension : The Insurance Certificate is an important legal document that must follow a prescribed lay-out. Look under Point 5, “Persons or classes of persons entitled to drive”. Here’s an example : This is where you need to check your documents very carefully, as some insurers provide DOC cover but others don’t. And even if your insurer does provide DOC cover, there are always differences in the rules and restrictions that each insurer applies to the cover. So it’s a minefield and you must check your own position carefully before getting into a borrowed vehicle. As a general rule though, the restrictions around DOC cover (if it’s provided at all) are as follows : That depends on your individual circumstances. Generally though, the pro’s and cons of the 2 options are as follows : Named Driver on Annual Policy Temporary Insurance You have 2 main options : If you intend for someone such as your partner or other family member to drive your car reasonably regularly (ie more than a couple of times a year) then your best bet is to add them as a Named Driver at inception or renewal of the policy. NB. Don’t be tempted to distort the truth about the extent of the additional driver’s use though, especially if they are a young driver. This is known as Fronting and can result in the insurer refusing to pay for any damage to your vehicle! If the Named Driver is a similar age to you and has a similar driving history, the chances are that adding them as a Named Driver will not be significantly more expensive than just insuring yourself to drive. However, if you choose to add several Named Drivers then the insurers are likely to be much less receptive, particularly if the additional drivers are of varying ages/experience. Away from planned/regular additional drivers, what about emergency situations, or occasional lending of your vehicle? The best advice is to tread very carefully – it is an offence to drive uninsured, so if you intend to lend you car to someone other than a Named Driver on your own policy, you will need to satisfy yourself that they have adequate insurance in place. They may well say “It’s ok, I’ve got my own Comprehensive policy and that means I can drive any vehicle” – but as we’ll examine in the FAQs that follow, this is rarely the case. Rather than taking their word for it, a better solution might be to direct them to one of the short-term insurance providers. There they will usually be able to buy a policy in their own name which will last for as long as they choose. It will be uploaded to the Motor Insurance Database (see later section on MID) and, best of all, you can rest assured that the No Claims Discount that you’ve earned on your own policy will not be jeopardised by any accident the borrower may have! Generally the answer to this is NO, your annual insurance policy covers you (and any Named Drivers you may have added) to drive your own car only. However there are 2 scenarios where the answer might be YES 2. Some policies include the Driving Other Cars (DOC) extension : more detail on this is provided in the following FAQs… This is a common question, and the answer is either “Both” or “Neither” depending on how you look at it! To explain in a bit more detail, most UK car insurance policies cover a Named Driver in a Specified Vehicle. So in other words, your insurance covers you while you drive your car. But that raises 2 important further questions : 1. does your insurance cover you while you drive another car? and 2. does your insurance cover someone else to drive your car? The answer to the first question is “Sometimes” and we’ll go into this in more detail in the further FAQs on Driving Other Cars. The answer to the second question is usually “No”, but there are a couple of exceptions where the answer might be “Yes”. These exceptions are : a) if you have added the other driver as a Named Driver on your policy b) if you have an Any Driver policy (these are very rare in the UK but you might have one if you have a motor policy linked to a High Net Worth household insurance contract) The comments above apply to privately-owned cars in the UK – different rules apply to company cars which are owned by businesses. These are usually insured under Motor Fleet policies, so if you have the use of a Company Car be sure to check your company’s fleet policy to see who is allowed to drive the vehicle. Please see the Learner section above for full details. In a nutshell you can take out short-term cover in your own name whilst you drive, or you can arrange to be added as a Named Driver to the annual insurance on the vehicle. NO! Insurers will always add restrictions/caveats to the DOC cover they provide – it’s not designed to cover a Bugatti Veyron! As well as the Insurance Certificate, there are 3 other places you can look to see what cover is being provided under the DOC extension : The Insurance Certificate is an important legal document that must follow a prescribed lay-out. Look under Point 5, “Persons or classes of persons entitled to drive”. Here’s an example : This is where you need to check your documents very carefully, as some insurers provide DOC cover but others don’t. And even if your insurer does provide DOC cover, there are always differences in the rules and restrictions that each insurer applies to the cover. So it’s a minefield and you must check your own position carefully before getting into a borrowed vehicle. As a general rule though, the restrictions around DOC cover (if it’s provided at all) are as follows : That depends on your individual circumstances. Generally though, the pro’s and cons of the 2 options are as follows : Named Driver on Annual Policy Temporary Insurance You have 2 main options : If you intend for someone such as your partner or other family member to drive your car reasonably regularly (ie more than a couple of times a year) then your best bet is to add them as a Named Driver at inception or renewal of the policy. NB. Don’t be tempted to distort the truth about the extent of the additional driver’s use though, especially if they are a young driver. This is known as Fronting and can result in the insurer refusing to pay for any damage to your vehicle! If the Named Driver is a similar age to you and has a similar driving history, the chances are that adding them as a Named Driver will not be significantly more expensive than just insuring yourself to drive. However, if you choose to add several Named Drivers then the insurers are likely to be much less receptive, particularly if the additional drivers are of varying ages/experience. Away from planned/regular additional drivers, what about emergency situations, or occasional lending of your vehicle? The best advice is to tread very carefully – it is an offence to drive uninsured, so if you intend to lend you car to someone other than a Named Driver on your own policy, you will need to satisfy yourself that they have adequate insurance in place. They may well say “It’s ok, I’ve got my own Comprehensive policy and that means I can drive any vehicle” – but as we’ll examine in the FAQs that follow, this is rarely the case. Rather than taking their word for it, a better solution might be to direct them to one of the short-term insurance providers. There they will usually be able to buy a policy in their own name which will last for as long as they choose. It will be uploaded to the Motor Insurance Database (see later section on MID) and, best of all, you can rest assured that the No Claims Discount that you’ve earned on your own policy will not be jeopardised by any accident the borrower may have! Generally the answer to this is NO, your annual insurance policy covers you (and any Named Drivers you may have added) to drive your own car only. However there are 2 scenarios where the answer might be YES 2. Some policies include the Driving Other Cars (DOC) extension : more detail on this is provided in the following FAQs… This is a common question, and the answer is either “Both” or “Neither” depending on how you look at it! To explain in a bit more detail, most UK car insurance policies cover a Named Driver in a Specified Vehicle. So in other words, your insurance covers you while you drive your car. But that raises 2 important further questions : 1. does your insurance cover you while you drive another car? and 2. does your insurance cover someone else to drive your car? The answer to the first question is “Sometimes” and we’ll go into this in more detail in the further FAQs on Driving Other Cars. The answer to the second question is usually “No”, but there are a couple of exceptions where the answer might be “Yes”. These exceptions are : a) if you have added the other driver as a Named Driver on your policy b) if you have an Any Driver policy (these are very rare in the UK but you might have one if you have a motor policy linked to a High Net Worth household insurance contract) The comments above apply to privately-owned cars in the UK – different rules apply to company cars which are owned by businesses. These are usually insured under Motor Fleet policies, so if you have the use of a Company Car be sure to check your company’s fleet policy to see who is allowed to drive the vehicle.

Car Sharing

Car Sharing