FAQs

Click on the heading under the Expand All arrow below to read our useful guides and FAQs

The Essentials

Learner

Car Sharing

Business Use

MID

Claims

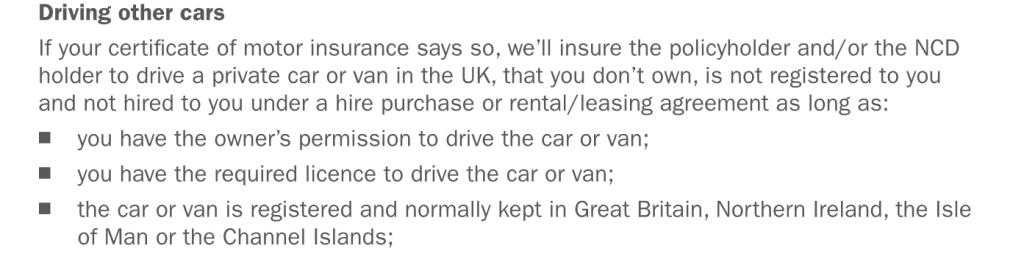

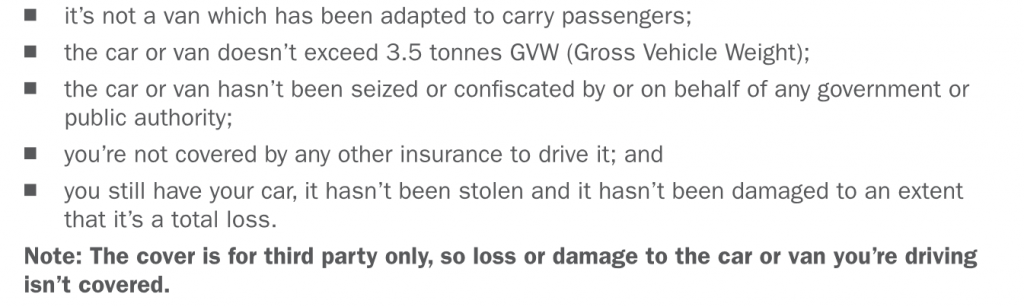

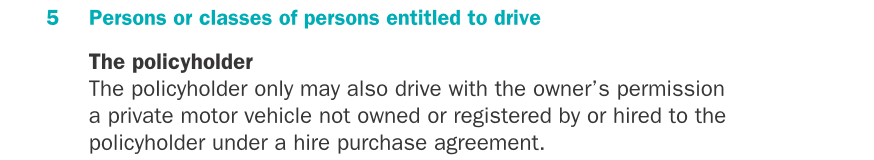

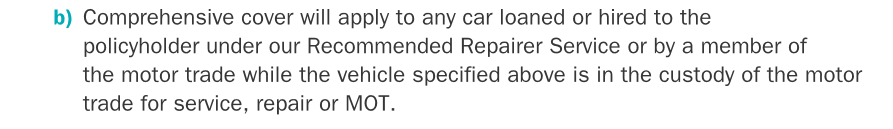

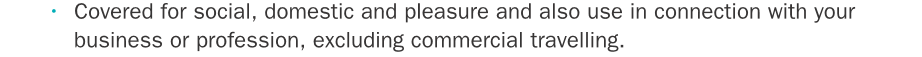

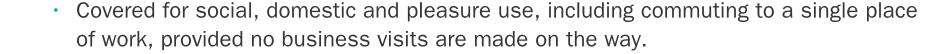

Normally if you make a claim on your car insurance policy you will move back down the NCD scale – usually 2 years, but sometimes more. The exception to this is if you can prove that the accident was not your fault – then your insurer may agree NOT to move you down the scale. However, proving that a claim was Non-Fault is not always straightforward – you will usually need to prove to your insurer that you have recovered your uninsured losses (e.g. your excess, the cost of any replacement vehicle or any additional travel costs you incurred) from the Third Party Driver who caused the accident. In the event that the Third Party Driver was uninsured it will be nigh on impossible to recover these costs, so some insurers have added an Uninsured Driver promise to their policy to say that you won’t have to pay an excess, and you won’t lose your no-claims discount if your car is hit by a driver who isn’t insured. You’ll still have to establish that the accident is not your fault though, and the driver of the other vehicle is identified and is not insured (see more on this in the next FAQ). The paragraph above may help some people, but nevertheless moving down the NCD scale that you’ve worked hard to climb up is generally bad news – especially for younger drivers where the difference between full NCD and zero NCD could be over a thousand pounds! Therefore to protect drivers from this big fall, most insurers offer NCD Protection. This costs you additional premium (typically in the 15-25% range so its not cheap) but it gives you the reassurance that if you do have a claim you will remain on the NCD level you’ve reached and won’t move down the NCD scale. (There’s usually a limit of 2 claims per insurance year before your NCD will be affected). NCD Protection can be a very useful addition to most annual car insurance policies. Bear in mind though that’s it’s not a guarantee, the insurer can still increase your premium at renewal irrespective of your NCD position and whether it’s protected. A no-claims discount (NCD), sometimes called a no-claims bonus, is a car insurance discount recognised by insurance providers. It’s a count of the number of years you haven’t made a claim on your car insurance policy. So for every year you drive without making a claim on your policy, you gain extra no-claims discount. The benefit of NCD usually plateaus at five years, but some companies offer further discount for six or more years. The amount of discount this qualifies you for tends to vary from insurer to insurer. The main types are : Other excesses : check your individual wording to see if there are any other excesses which apply in your individual circumstances. Common examples include : An excess is the amount you must pay when you make a claim on your policy. In other words, it’s the amount you agree to contribute towards the cost of a claim, with the insurer covering the remaining amount. So if your vehicle is damaged and the cost of repair is agreed at £1,250, then if you had no excess the amount the insurer would pay would be £1,250. However if your policy had a £500 excess, the insurer would only pay £750 as you’d have to pay the remaining £500 yourself. There are 3 types of motor insurance : The cover provided by the 3 different types is : Even if you do not use your vehicle you are still required to insure it, unless you officially register your vehicle as off the road (SORN). You can find information on how to do this here. Yes : if you want to drive a vehicle on UK roads you must have motor insurance. Individuals working collectively to protect one another against changes in fortune is as old as civilisation. People throughout the world and throughout history have developed different organisations and structures, such as the Roman colleges and Anglo Saxon gilds, to guarantee mutual protection in wealth and adversity. Motor insurance in the UK is believed to date back to 1896, with policies based on those previously used for horse-drawn vehicles. The first motor insurance based on variable premiums depending on the horse power, age and type of vehicle was introduced by the Red Cross Indemnity Insurance Company in 1906. The basic idea of insurance is the pooling of resources in order to minimise the risk and impact of loss. In other words, in a population who are all exposed to risk, many people pay an affordable amount in order to cover the losses of the unfortunate few. Without the benefit of insurance, these losses would have a significant impact on those members of the population who suffer them. As long as you have the owner’s permission, and you’re accompanied by a suitably qualified driver (aged at least 21, full licence for at least 3 years) then you should be ok to borrow a car for driving practice – but you still need to think about the insurance. There are 2 main options : There are pro’s and cons of each method : You need to tread very carefully here. If you state that another person (eg. a parent or older relative) is the registered keeper and/or the main user of the vehicle when that is not in fact the case, then you could be guilty of Fronting. Insurance company claims departments are very switched on to the risk of Fronting and will investigate claims involving young drivers very closely to ensure it is not taking place. If they do find you to be guilty of Fronting then you some or all of any claim that you make could be declined, and you may have difficulty in securing any further insurance cover for your vehicle. f you own a car then it needs to be insured, whether you use it or not (unless it’s SORN). You have 2 main options : Again you’ll need to check with the individual provider, but typically Yes, Learner policies are submitted to the Motor Insurance Database (MID). Don’t forget though that there will almost always be a delay between incepting a Learner policy and it being uploaded onto MID, so you should always make sure you have your insurance documents to hand when you are driving. Fortunately this usually includes electronic copies of documents, so it’s usually just a case of remembering your phone! A Learner can only drive when supervised by a person who is at least 21 years old and has a full valid driving licence, which they have held for at least three years. However, most Learner Driver Insurance policies require the accompanying driver to be older than this – many will only provide cover if the accompanying driver is aged 25 and over, whilst with others it’s 23 and over – so its vital that you check your own individual policy details first to see which limit applies to you. When you are supervising a learner driver, you have the same legal responsibilities as if you were driving. For example, the drink drive laws and the ban on using mobile phone apply to anyone who is supervising a learner – you are deemed to be in control of the vehicle. It costs £34 to apply online. You can pay by MasterCard, Visa, Electron or Delta debit or credit card. You’ll need to provide : Your licence should arrive within one week if you apply online. It may take longer if DVLA need to make additional checks. Alternatively, you can apply by post. Fill in form D1 available from the DVLA form ordering service and certain Post Office branches. It costs £43 to apply by post. Make your cheque or postal order payable to DVLA (do not send cash). You’ll need to include : You must send original documents. Send your application and payment to : Your provisional licence should arrive within 3 weeks. Contact DVLA if it has not arrived by then. All prices and details correct at time of writing (December 2019) Most people can start learning to drive when they turn 17. In readiness for this, you can apply for a Provisional Licence when you are at least 15 years and 9 months old. You can start driving a car when you’re 17, or 16 if you get, or have applied for, the enhanced rate of the mobility component of Personal Independence Payment (PIP). Please see the Learner section above for full details. In a nutshell you can take out short-term cover in your own name whilst you drive, or you can arrange to be added as a Named Driver to the annual insurance on the vehicle. NO! Insurers will always add restrictions/caveats to the DOC cover they provide – it’s not designed to cover a Bugatti Veyron! As well as the Insurance Certificate, there are 3 other places you can look to see what cover is being provided under the DOC extension : The Insurance Certificate is an important legal document that must follow a prescribed lay-out. Look under Point 5, “Persons or classes of persons entitled to drive”. Here’s an example : This is where you need to check your documents very carefully, as some insurers provide DOC cover but others don’t. And even if your insurer does provide DOC cover, there are always differences in the rules and restrictions that each insurer applies to the cover. So it’s a minefield and you must check your own position carefully before getting into a borrowed vehicle. As a general rule though, the restrictions around DOC cover (if it’s provided at all) are as follows : That depends on your individual circumstances. Generally though, the pro’s and cons of the 2 options are as follows : Named Driver on Annual Policy Temporary Insurance You have 2 main options : If you intend for someone such as your partner or other family member to drive your car reasonably regularly (ie more than a couple of times a year) then your best bet is to add them as a Named Driver at inception or renewal of the policy. NB. Don’t be tempted to distort the truth about the extent of the additional driver’s use though, especially if they are a young driver. This is known as Fronting and can result in the insurer refusing to pay for any damage to your vehicle! If the Named Driver is a similar age to you and has a similar driving history, the chances are that adding them as a Named Driver will not be significantly more expensive than just insuring yourself to drive. However, if you choose to add several Named Drivers then the insurers are likely to be much less receptive, particularly if the additional drivers are of varying ages/experience. Away from planned/regular additional drivers, what about emergency situations, or occasional lending of your vehicle? The best advice is to tread very carefully – it is an offence to drive uninsured, so if you intend to lend you car to someone other than a Named Driver on your own policy, you will need to satisfy yourself that they have adequate insurance in place. They may well say “It’s ok, I’ve got my own Comprehensive policy and that means I can drive any vehicle” – but as we’ll examine in the FAQs that follow, this is rarely the case. Rather than taking their word for it, a better solution might be to direct them to one of the short-term insurance providers. There they will usually be able to buy a policy in their own name which will last for as long as they choose. It will be uploaded to the Motor Insurance Database (see later section on MID) and, best of all, you can rest assured that the No Claims Discount that you’ve earned on your own policy will not be jeopardised by any accident the borrower may have! Generally the answer to this is NO, your annual insurance policy covers you (and any Named Drivers you may have added) to drive your own car only. However there are 2 scenarios where the answer might be YES 2. Some policies include the Driving Other Cars (DOC) extension : more detail on this is provided in the following FAQs… This is a common question, and the answer is either “Both” or “Neither” depending on how you look at it! To explain in a bit more detail, most UK car insurance policies cover a Named Driver in a Specified Vehicle. So in other words, your insurance covers you while you drive your car. But that raises 2 important further questions : 1. does your insurance cover you while you drive another car? and 2. does your insurance cover someone else to drive your car? The answer to the first question is “Sometimes” and we’ll go into this in more detail in the further FAQs on Driving Other Cars. The answer to the second question is usually “No”, but there are a couple of exceptions where the answer might be “Yes”. These exceptions are : a) if you have added the other driver as a Named Driver on your policy b) if you have an Any Driver policy (these are very rare in the UK but you might have one if you have a motor policy linked to a High Net Worth household insurance contract) The comments above apply to privately-owned cars in the UK – different rules apply to company cars which are owned by businesses. These are usually insured under Motor Fleet policies, so if you have the use of a Company Car be sure to check your company’s fleet policy to see who is allowed to drive the vehicle. It can’t! But…your insurer may be able to. If for example you are paid to use your car to deliver food in the evening or at weekends, but you choose not to disclose this fact to your insurance company, then any claim you submit will be closely scrutinised. The claims handler will ask what the car was being used for at the time of the accident, and will look to corroborate the answer you give with information from other sources. Honesty is the best policy – tell your insurance company in advance if your circumstances change and you take on additional work which involves using your vehicle as a taxi or to deliver goods. Your premium will go up, but you’ll have the peace of mind that you’re driving legally and you’re properly insured! Many delivery drivers aren’t aware that they can’t just jump in their car and start using it to deliver pizzas or curries. It’s a mistake that could cost them their job, hundreds of pounds in fines and even their driver’s licence. Standard car insurance does NOT cover you for delivering fast food…even if you have ‘business use’ added to your policy. If it becomes known to the authorities that you are operating without the correct type of insurance for delivering hot food, you will be penalised for driving without valid insurance. Fortunately though there are a number of specialist insurance providers who can help you navigate this tricky area. To be properly covered and work within the law, you will need to ensure that you have fast food delivery driver insurance. Hot food delivery insurance is a special form of hire and reward insurance. Hire and reward simply means delivering a passenger or somebody’s goods from A to B in exchange for payment. Using a broker that specialises in hire and reward insurance policies will definitely help to keep the cost of your cover down, whilst at the same time ensuring that you stay legal. In a nutshell : you may do, but it’s certainly not guaranteed. I can use my own car insurance policy to illustrate this. I’m the Policyholder, and my partner is the only Named Driver on the policy. Here’s what my insurance schedule says that I can use the vehicle for : And here’s what my partner is covered for : So in this case if my partner borrows my car then they have cover for Social, Domestic, Pleasure and Commuting to a single place of work – but they don’t have cover for any other business visits they may make. This can be a common cause of uninsured driving – if my partner borrowed my car (say whilst their vehicle was being serviced) then they’d be covered for their commute to and from their normal office but they WOULDN’T be covered if they drove to a training course, or to visit a client, or even to drop a letter off at the Post Office on their way home! The answer to this one is……”It depends!” If for example the vehicle is a company car and the company for whom you work are responsible for the insurance, then as long as you and your colleague are both authorised drivers on the company Motor Fleet policy (and you both have the correct licences and permissions to drive the vehicle) then you should be ok to share the driving. You’ll still need to check beforehand though and get confirmation from your admin team – it’s not unusual for Fleet insurers to restrict driving on certain higher powered or more expensive vehicles, say to named drivers only or to drivers over a certain age. If the colleague does not normally drive company cars, then it’s even more important to check before they get behind the wheel. Sometimes in situations like this the Fleet insurer will add the colleague as a temporary authorised driver but depending on the colleague’s experience/driving history they may decide to impose additional terms. This might be an increased excess, or cover reduced to Third Party Only whilst the colleague drives. If the vehicle is not a company car, there are still a number of things you’ll need to check before the colleague drives : – if the colleague is likely to need repeated use, is it worth adding the colleague as an Additional Driver on your annual policy? If you decide to do this, make sure you tell the insurer that the colleague requires Business Use. – if the sharing of the driving is a one-off/unlikely to be regularly repeated, you could direct your colleague towards a temporary insurance policy to cover their use of your vehicle. The good news here is that most short-term insurance providers include Class 1 Business Use in their standard cover – just make sure your colleague checks this before they buy their short-term policy, as sometimes it’s difficult to get a refund if you do realise you’ve made a mistake! – another possibility is that the colleague has Driving Other Cars (DOC) cover under their own insurance policy. They will need to check this extremely carefully though : as the Car Sharing FAQs section above shows, this cover is not provided universally and when it is provided it usually comes with a lot of strings attached! If you drive to the station, then “Yes” because that part of your journey counts as Commuting. If you don’t drive to the station, then on the face of it “No” – but tread warily… Commuting cover will typically add around 10-15% to the cost of your insurance. If you chose not to buy this cover, then your annual insurance will not cover you : – if you use your car tyo drive to work in the event of a train strike or other know disruption – if you drive to a training course or to another office These scenarios highlight one of the main problems with annual car insurance : its inflexibility. When your annual insurer asks “Do you want to add Commuting cover?” the possible answers are either “Yes” (which means you’ve got it for 365 out of 365 days a year) or “No” (which means you’ve got it for 0 out of 365 days a year). If there was a box that said “No, but I might just need it once or twice a year” then that would be many people’s ideal answer, but unfortunately it doesn’t exist! However, there is some light at the end of this particular tunnel. In recent years, the short-term insurance market has become more established and these companies have led the way with flexible, innovative products which allow customers to “fill in the gaps” between annual insurance. One such product is Business Use Only Insurance. For a very reasonable premium (typically less than £10 a day) customers who already have Social Domestic and Pleasure cover can add Business Use just on the day(s) they need it. in fact it can even be bought by the hour! This might just help you out of some of the situations outlined above. This is a very important question, as UK insurance companies tend to use a very narrow definition. You’ll need to check with your individual insurer to see what definition they use specifically, but typically insurers define commuting as journeys to and from your usual single place of work. Have a think about scenarios that could fall outside of this definition : – you’re asked to cover an illness at a nearby branch for a few days so as they’re not short-staffed – you work between 2 offices (an increasingly common occurrence as companies for example split Operations and Sales and Marketing between different “Centres of Excellence”) – your company organises a training day at a nearby hotel – your role is normally office-based, but one of your company’s biggest clients is on your way home so you sometimes drop something off there on your way home – you take a second job And so on… And even though this may just seem like semantics, the implications of getting it wrong can be severe : if the police have cause to stop you – for any reason – and discover you’re not insured for your daily commute, you could receive six penalty points and a fine of up to £5,000. The basic classes are : Yes, ANPR (Automatic Number Plate Recognition) cameras use data from the MID to assist in the identification of uninsured vehicles. Yes, the police have direct access to the MID to assist in the identification of uninsured vehicles. No, it is a legal requirement that all motor insurers must provide the information to the MID. Yes. All motor insurers must abide by Department for Transport obligations for the timely and accurate supply of data. Insurers can provide this data to the database themselves or via an authorised representative. Data is loaded by insurance companies, authorised insurance representatives and brokers. The MID can also be updated by the policyholder themselves and is subject to strict control. If, after receiving an Insurance Advisory Letter (IAL), a registered keeper fails to comply with the advice set out in the letter they will face: CIE measures are in addition to the powers the police already have to seize an uninsured vehicle being used on the road. As part of the Continuous Insurance Enforcement (CIE) legislation, it is an offence to be the keeper of a vehicle without insurance unless you have notified the Driver and Vehicle Licensing Agency (DVLA) that your vehicle is being kept off the road using a Statutory Off Road Notice (SORN). The Motor Insurance Database (MID) is the central record of all insured vehicles in the UK. Managed by the Motor Insurers’ Bureau (MIB), the MID is used by the Police and the DVLA to enforce motor insurance law – ensuring that vehicles driven on our roads are insured at all times. You need to report the incident to the police in the following circumstances: The first thing you should do is report the theft to the nearest police station and obtain a crime reference number. Then contact your insurance company on their claims number and they will take the details from you. After this, a number of insurance industry database checks are carried out – these are designed to protect customers from fraud. In some cases a Claims Assessor may also be appointed to discuss the claim with you. When all enquiries are successfully completed an offer will be made to settle your claim. If the cost of repairs exceed the market value of your car then it is likely your insurer will consider it to be beyond economic repair. This is often referred to as a total loss or write-off. What normally happens is that an engineer from the insurance company or appointed by them will inspect your car and place a value on it, taking account of market trends and car value guides. They will take into account the condition of the car before the incident took place including the bodywork, mileage, interior and service history. Once the engineer has completed their report they will carry out a series of industry database checks designed to safeguard against fraud. Once these have been successfully completed, payment will be sent to you, subject to the deduction of any excess. Your insurance company will still deal with your claim : their priority should be to get your car repaired, or a settlement to you if it is a total loss (write-off). After this, they will try to recover their outlay from the person responsible for the accident (or their insurance company). If they are successful then making the claim will not affect your No Claims Bonus. This is when it is really important to get statements from independent witnesses, who saw the accident. Plus photos from the scene (but only it is safe to take them). Armed with these, your insurer will do their best to persuade the other driver (or their insurer) that the accident was their fault by presenting them with all the evidence that you have provided us. Your insurer should always fight your corner, but on occasions if the evidence does not fully support either driver’s version of the incident, everybody involved may have to take some responsibility. If this happens your insurer will negotiate the best possible settlement with the other driver/their insurer. If the incident is not your fault and your insurer makes a full recovery from the responsible person, your no claims discount will be unaffected. However if an incident occurs which is not your fault, and they are unable to recover the cost, your no claims discount will be reduced at the renewal of your policy. How much NCD you will lose depends on your insurer, but typically for each incident settled against you, you will lose 2 years No Claims Bonus. So if you started your policy with 5 years No Claims Bonus and had an accident that was your fault, you would still have 3 years No Claims Bonus at the start of the next policy term. If the incident is your fault your no claims discount will be reduced. However, your no claims discount may be protected if you have paid extra. In the event of a theft claim your insurer will probably reduce your no claims discount, as it is highly unlikely they will be able to locate the culprits and recover the costs. Insurers will always prefer you to use one of their Approved Repairers to repair your car. They will argue that their Approved Repairers are carefully scrutinised and appointed to provide the highest customer service and quality of repairs for their customers. They may also throw in other benefits – such as the Approved Repairer will provide you with a free courtesy car for the duration of repairs. And Authorised Repairer repairs will be carried out in accordance with recognised industry standards, guaranteed for 3 years and all replaced parts are manufacturer-approved. Further, Approved Repairers can usually start work more quickly as the need for sending estimates into the insurer to get them approved is removed (the insurers can often see the damage to your vehicle via video technology in the repair shop). But having said that, you do have the choice of using your own repairer. Doing so means though that the insurer can’t guarantee the work and you will need to obtain an estimate for them to approve before work can commence, so it might take longer. And you may lose your right to a courtesy car. If you were not at fault or were only partially at fault for the accident, you may be able to recover some expenses from the person responsible or their insurers. This could include things like your policy excess, hire car costs, taxi costs and accommodation. You will need to keep receipts, as these will be needed to provide evidence of your claim. If you have motoring legal protection (sometimes called motor legal expenses), their claims handlers will negotiate with the other party’s insurer to recover your costs on your behalf and will remain in contact with you during the period of negotiation. It can take up to 6 months to reach agreement with the other party’s insurer. If you don’t have motoring legal protection, you are still entitled to try and claim these costs back from the other party/their insurer, but you will have to do so on your own. This is one of the benefits of the MID that many people are unaware of. If there has been an accident and you need to check the other vehicle is insured, for a fee of £4.50 you can search the Motor Insurance Database (MID) to help determine if the other vehicle is insured. You’ll need the date of the accident and the registration details of the other vehicle. If the registration is found on the MID, you will receive on screen the insurance details: policy number, name of insurer and the claims contact details to help you progress a claim. If you have been recently involved in a Road Traffic Accident (RTA) you can check the insurance details of the other parties involved on the MID (Motor Insurance Database) There are two ways to check if a vehicle is insured after an accident: a one-off askMID search or using the askMID Roadside service. The ‘askMID Roadside’ service is intended for use on a smart mobile device at the side of the road. It allows you to instantly check the Motor Insurance Database (MID) and confirm the insurance details of the other parties involved in an accident. In order to complete the simple askMID Roadside check on a mobile device you need to have the following pieces of information to hand: If you are on a smart mobile device use the askMID Roadside service now. If you are not at the roadside then you can obtain the same information by completing a one-off askMID search. Find out more about completing a one-off search of the database. Here’s a useful checklist of what to do in the event of a car accident : In a bit more detail : Normally if you make a claim on your car insurance policy you will move back down the NCD scale – usually 2 years, but sometimes more. The exception to this is if you can prove that the accident was not your fault – then your insurer may agree NOT to move you down the scale. However, proving that a claim was Non-Fault is not always straightforward – you will usually need to prove to your insurer that you have recovered your uninsured losses (e.g. your excess, the cost of any replacement vehicle or any additional travel costs you incurred) from the Third Party Driver who caused the accident. In the event that the Third Party Driver was uninsured it will be nigh on impossible to recover these costs, so some insurers have added an Uninsured Driver promise to their policy to say that you won’t have to pay an excess, and you won’t lose your no-claims discount if your car is hit by a driver who isn’t insured. You’ll still have to establish that the accident is not your fault though, and the driver of the other vehicle is identified and is not insured (see more on this in the next FAQ). The paragraph above may help some people, but nevertheless moving down the NCD scale that you’ve worked hard to climb up is generally bad news – especially for younger drivers where the difference between full NCD and zero NCD could be over a thousand pounds! Therefore to protect drivers from this big fall, most insurers offer NCD Protection. This costs you additional premium (typically in the 15-25% range so its not cheap) but it gives you the reassurance that if you do have a claim you will remain on the NCD level you’ve reached and won’t move down the NCD scale. (There’s usually a limit of 2 claims per insurance year before your NCD will be affected). NCD Protection can be a very useful addition to most annual car insurance policies. Bear in mind though that’s it’s not a guarantee, the insurer can still increase your premium at renewal irrespective of your NCD position and whether it’s protected. A no-claims discount (NCD), sometimes called a no-claims bonus, is a car insurance discount recognised by insurance providers. It’s a count of the number of years you haven’t made a claim on your car insurance policy. So for every year you drive without making a claim on your policy, you gain extra no-claims discount. The benefit of NCD usually plateaus at five years, but some companies offer further discount for six or more years. The amount of discount this qualifies you for tends to vary from insurer to insurer. The main types are : Other excesses : check your individual wording to see if there are any other excesses which apply in your individual circumstances. Common examples include : An excess is the amount you must pay when you make a claim on your policy. In other words, it’s the amount you agree to contribute towards the cost of a claim, with the insurer covering the remaining amount. So if your vehicle is damaged and the cost of repair is agreed at £1,250, then if you had no excess the amount the insurer would pay would be £1,250. However if your policy had a £500 excess, the insurer would only pay £750 as you’d have to pay the remaining £500 yourself. There are 3 types of motor insurance : The cover provided by the 3 different types is : Even if you do not use your vehicle you are still required to insure it, unless you officially register your vehicle as off the road (SORN). You can find information on how to do this here. Yes : if you want to drive a vehicle on UK roads you must have motor insurance. Individuals working collectively to protect one another against changes in fortune is as old as civilisation. People throughout the world and throughout history have developed different organisations and structures, such as the Roman colleges and Anglo Saxon gilds, to guarantee mutual protection in wealth and adversity. Motor insurance in the UK is believed to date back to 1896, with policies based on those previously used for horse-drawn vehicles. The first motor insurance based on variable premiums depending on the horse power, age and type of vehicle was introduced by the Red Cross Indemnity Insurance Company in 1906. The basic idea of insurance is the pooling of resources in order to minimise the risk and impact of loss. In other words, in a population who are all exposed to risk, many people pay an affordable amount in order to cover the losses of the unfortunate few. Without the benefit of insurance, these losses would have a significant impact on those members of the population who suffer them. As long as you have the owner’s permission, and you’re accompanied by a suitably qualified driver (aged at least 21, full licence for at least 3 years) then you should be ok to borrow a car for driving practice – but you still need to think about the insurance. There are 2 main options : There are pro’s and cons of each method : You need to tread very carefully here. If you state that another person (eg. a parent or older relative) is the registered keeper and/or the main user of the vehicle when that is not in fact the case, then you could be guilty of Fronting. Insurance company claims departments are very switched on to the risk of Fronting and will investigate claims involving young drivers very closely to ensure it is not taking place. If they do find you to be guilty of Fronting then you some or all of any claim that you make could be declined, and you may have difficulty in securing any further insurance cover for your vehicle. f you own a car then it needs to be insured, whether you use it or not (unless it’s SORN). You have 2 main options : Again you’ll need to check with the individual provider, but typically Yes, Learner policies are submitted to the Motor Insurance Database (MID). Don’t forget though that there will almost always be a delay between incepting a Learner policy and it being uploaded onto MID, so you should always make sure you have your insurance documents to hand when you are driving. Fortunately this usually includes electronic copies of documents, so it’s usually just a case of remembering your phone! A Learner can only drive when supervised by a person who is at least 21 years old and has a full valid driving licence, which they have held for at least three years. However, most Learner Driver Insurance policies require the accompanying driver to be older than this – many will only provide cover if the accompanying driver is aged 25 and over, whilst with others it’s 23 and over – so its vital that you check your own individual policy details first to see which limit applies to you. When you are supervising a learner driver, you have the same legal responsibilities as if you were driving. For example, the drink drive laws and the ban on using mobile phone apply to anyone who is supervising a learner – you are deemed to be in control of the vehicle. It costs £34 to apply online. You can pay by MasterCard, Visa, Electron or Delta debit or credit card. You’ll need to provide : Your licence should arrive within one week if you apply online. It may take longer if DVLA need to make additional checks. Alternatively, you can apply by post. Fill in form D1 available from the DVLA form ordering service and certain Post Office branches. It costs £43 to apply by post. Make your cheque or postal order payable to DVLA (do not send cash). You’ll need to include : You must send original documents. Send your application and payment to : Your provisional licence should arrive within 3 weeks. Contact DVLA if it has not arrived by then. All prices and details correct at time of writing (December 2019) Most people can start learning to drive when they turn 17. In readiness for this, you can apply for a Provisional Licence when you are at least 15 years and 9 months old. You can start driving a car when you’re 17, or 16 if you get, or have applied for, the enhanced rate of the mobility component of Personal Independence Payment (PIP). Please see the Learner section above for full details. In a nutshell you can take out short-term cover in your own name whilst you drive, or you can arrange to be added as a Named Driver to the annual insurance on the vehicle. NO! Insurers will always add restrictions/caveats to the DOC cover they provide – it’s not designed to cover a Bugatti Veyron! As well as the Insurance Certificate, there are 3 other places you can look to see what cover is being provided under the DOC extension : The Insurance Certificate is an important legal document that must follow a prescribed lay-out. Look under Point 5, “Persons or classes of persons entitled to drive”. Here’s an example : This is where you need to check your documents very carefully, as some insurers provide DOC cover but others don’t. And even if your insurer does provide DOC cover, there are always differences in the rules and restrictions that each insurer applies to the cover. So it’s a minefield and you must check your own position carefully before getting into a borrowed vehicle. As a general rule though, the restrictions around DOC cover (if it’s provided at all) are as follows : That depends on your individual circumstances. Generally though, the pro’s and cons of the 2 options are as follows : Named Driver on Annual Policy Temporary Insurance You have 2 main options : If you intend for someone such as your partner or other family member to drive your car reasonably regularly (ie more than a couple of times a year) then your best bet is to add them as a Named Driver at inception or renewal of the policy. NB. Don’t be tempted to distort the truth about the extent of the additional driver’s use though, especially if they are a young driver. This is known as Fronting and can result in the insurer refusing to pay for any damage to your vehicle! If the Named Driver is a similar age to you and has a similar driving history, the chances are that adding them as a Named Driver will not be significantly more expensive than just insuring yourself to drive. However, if you choose to add several Named Drivers then the insurers are likely to be much less receptive, particularly if the additional drivers are of varying ages/experience. Away from planned/regular additional drivers, what about emergency situations, or occasional lending of your vehicle? The best advice is to tread very carefully – it is an offence to drive uninsured, so if you intend to lend you car to someone other than a Named Driver on your own policy, you will need to satisfy yourself that they have adequate insurance in place. They may well say “It’s ok, I’ve got my own Comprehensive policy and that means I can drive any vehicle” – but as we’ll examine in the FAQs that follow, this is rarely the case. Rather than taking their word for it, a better solution might be to direct them to one of the short-term insurance providers. There they will usually be able to buy a policy in their own name which will last for as long as they choose. It will be uploaded to the Motor Insurance Database (see later section on MID) and, best of all, you can rest assured that the No Claims Discount that you’ve earned on your own policy will not be jeopardised by any accident the borrower may have! Generally the answer to this is NO, your annual insurance policy covers you (and any Named Drivers you may have added) to drive your own car only. However there are 2 scenarios where the answer might be YES 2. Some policies include the Driving Other Cars (DOC) extension : more detail on this is provided in the following FAQs… This is a common question, and the answer is either “Both” or “Neither” depending on how you look at it! To explain in a bit more detail, most UK car insurance policies cover a Named Driver in a Specified Vehicle. So in other words, your insurance covers you while you drive your car. But that raises 2 important further questions : 1. does your insurance cover you while you drive another car? and 2. does your insurance cover someone else to drive your car? The answer to the first question is “Sometimes” and we’ll go into this in more detail in the further FAQs on Driving Other Cars. The answer to the second question is usually “No”, but there are a couple of exceptions where the answer might be “Yes”. These exceptions are : a) if you have added the other driver as a Named Driver on your policy b) if you have an Any Driver policy (these are very rare in the UK but you might have one if you have a motor policy linked to a High Net Worth household insurance contract) The comments above apply to privately-owned cars in the UK – different rules apply to company cars which are owned by businesses. These are usually insured under Motor Fleet policies, so if you have the use of a Company Car be sure to check your company’s fleet policy to see who is allowed to drive the vehicle. It can’t! But…your insurer may be able to. If for example you are paid to use your car to deliver food in the evening or at weekends, but you choose not to disclose this fact to your insurance company, then any claim you submit will be closely scrutinised. The claims handler will ask what the car was being used for at the time of the accident, and will look to corroborate the answer you give with information from other sources. Honesty is the best policy – tell your insurance company in advance if your circumstances change and you take on additional work which involves using your vehicle as a taxi or to deliver goods. Your premium will go up, but you’ll have the peace of mind that you’re driving legally and you’re properly insured! Many delivery drivers aren’t aware that they can’t just jump in their car and start using it to deliver pizzas or curries. It’s a mistake that could cost them their job, hundreds of pounds in fines and even their driver’s licence. Standard car insurance does NOT cover you for delivering fast food…even if you have ‘business use’ added to your policy. If it becomes known to the authorities that you are operating without the correct type of insurance for delivering hot food, you will be penalised for driving without valid insurance. Fortunately though there are a number of specialist insurance providers who can help you navigate this tricky area. To be properly covered and work within the law, you will need to ensure that you have fast food delivery driver insurance. Hot food delivery insurance is a special form of hire and reward insurance. Hire and reward simply means delivering a passenger or somebody’s goods from A to B in exchange for payment. Using a broker that specialises in hire and reward insurance policies will definitely help to keep the cost of your cover down, whilst at the same time ensuring that you stay legal. In a nutshell : you may do, but it’s certainly not guaranteed. I can use my own car insurance policy to illustrate this. I’m the Policyholder, and my partner is the only Named Driver on the policy. Here’s what my insurance schedule says that I can use the vehicle for : And here’s what my partner is covered for : So in this case if my partner borrows my car then they have cover for Social, Domestic, Pleasure and Commuting to a single place of work – but they don’t have cover for any other business visits they may make. This can be a common cause of uninsured driving – if my partner borrowed my car (say whilst their vehicle was being serviced) then they’d be covered for their commute to and from their normal office but they WOULDN’T be covered if they drove to a training course, or to visit a client, or even to drop a letter off at the Post Office on their way home! The answer to this one is……”It depends!” If for example the vehicle is a company car and the company for whom you work are responsible for the insurance, then as long as you and your colleague are both authorised drivers on the company Motor Fleet policy (and you both have the correct licences and permissions to drive the vehicle) then you should be ok to share the driving. You’ll still need to check beforehand though and get confirmation from your admin team – it’s not unusual for Fleet insurers to restrict driving on certain higher powered or more expensive vehicles, say to named drivers only or to drivers over a certain age. If the colleague does not normally drive company cars, then it’s even more important to check before they get behind the wheel. Sometimes in situations like this the Fleet insurer will add the colleague as a temporary authorised driver but depending on the colleague’s experience/driving history they may decide to impose additional terms. This might be an increased excess, or cover reduced to Third Party Only whilst the colleague drives. If the vehicle is not a company car, there are still a number of things you’ll need to check before the colleague drives : – if the colleague is likely to need repeated use, is it worth adding the colleague as an Additional Driver on your annual policy? If you decide to do this, make sure you tell the insurer that the colleague requires Business Use. – if the sharing of the driving is a one-off/unlikely to be regularly repeated, you could direct your colleague towards a temporary insurance policy to cover their use of your vehicle. The good news here is that most short-term insurance providers include Class 1 Business Use in their standard cover – just make sure your colleague checks this before they buy their short-term policy, as sometimes it’s difficult to get a refund if you do realise you’ve made a mistake! – another possibility is that the colleague has Driving Other Cars (DOC) cover under their own insurance policy. They will need to check this extremely carefully though : as the Car Sharing FAQs section above shows, this cover is not provided universally and when it is provided it usually comes with a lot of strings attached! If you drive to the station, then “Yes” because that part of your journey counts as Commuting. If you don’t drive to the station, then on the face of it “No” – but tread warily… Commuting cover will typically add around 10-15% to the cost of your insurance. If you chose not to buy this cover, then your annual insurance will not cover you : – if you use your car tyo drive to work in the event of a train strike or other know disruption – if you drive to a training course or to another office These scenarios highlight one of the main problems with annual car insurance : its inflexibility. When your annual insurer asks “Do you want to add Commuting cover?” the possible answers are either “Yes” (which means you’ve got it for 365 out of 365 days a year) or “No” (which means you’ve got it for 0 out of 365 days a year). If there was a box that said “No, but I might just need it once or twice a year” then that would be many people’s ideal answer, but unfortunately it doesn’t exist! However, there is some light at the end of this particular tunnel. In recent years, the short-term insurance market has become more established and these companies have led the way with flexible, innovative products which allow customers to “fill in the gaps” between annual insurance. One such product is Business Use Only Insurance. For a very reasonable premium (typically less than £10 a day) customers who already have Social Domestic and Pleasure cover can add Business Use just on the day(s) they need it. in fact it can even be bought by the hour! This might just help you out of some of the situations outlined above. This is a very important question, as UK insurance companies tend to use a very narrow definition. You’ll need to check with your individual insurer to see what definition they use specifically, but typically insurers define commuting as journeys to and from your usual single place of work. Have a think about scenarios that could fall outside of this definition : – you’re asked to cover an illness at a nearby branch for a few days so as they’re not short-staffed – you work between 2 offices (an increasingly common occurrence as companies for example split Operations and Sales and Marketing between different “Centres of Excellence”) – your company organises a training day at a nearby hotel – your role is normally office-based, but one of your company’s biggest clients is on your way home so you sometimes drop something off there on your way home – you take a second job And so on… And even though this may just seem like semantics, the implications of getting it wrong can be severe : if the police have cause to stop you – for any reason – and discover you’re not insured for your daily commute, you could receive six penalty points and a fine of up to £5,000. The basic classes are : Yes, ANPR (Automatic Number Plate Recognition) cameras use data from the MID to assist in the identification of uninsured vehicles. Yes, the police have direct access to the MID to assist in the identification of uninsured vehicles. No, it is a legal requirement that all motor insurers must provide the information to the MID. Yes. All motor insurers must abide by Department for Transport obligations for the timely and accurate supply of data. Insurers can provide this data to the database themselves or via an authorised representative. Data is loaded by insurance companies, authorised insurance representatives and brokers. The MID can also be updated by the policyholder themselves and is subject to strict control. If, after receiving an Insurance Advisory Letter (IAL), a registered keeper fails to comply with the advice set out in the letter they will face: CIE measures are in addition to the powers the police already have to seize an uninsured vehicle being used on the road. As part of the Continuous Insurance Enforcement (CIE) legislation, it is an offence to be the keeper of a vehicle without insurance unless you have notified the Driver and Vehicle Licensing Agency (DVLA) that your vehicle is being kept off the road using a Statutory Off Road Notice (SORN). The Motor Insurance Database (MID) is the central record of all insured vehicles in the UK. Managed by the Motor Insurers’ Bureau (MIB), the MID is used by the Police and the DVLA to enforce motor insurance law – ensuring that vehicles driven on our roads are insured at all times. You need to report the incident to the police in the following circumstances: The first thing you should do is report the theft to the nearest police station and obtain a crime reference number. Then contact your insurance company on their claims number and they will take the details from you. After this, a number of insurance industry database checks are carried out – these are designed to protect customers from fraud. In some cases a Claims Assessor may also be appointed to discuss the claim with you. When all enquiries are successfully completed an offer will be made to settle your claim. If the cost of repairs exceed the market value of your car then it is likely your insurer will consider it to be beyond economic repair. This is often referred to as a total loss or write-off. What normally happens is that an engineer from the insurance company or appointed by them will inspect your car and place a value on it, taking account of market trends and car value guides. They will take into account the condition of the car before the incident took place including the bodywork, mileage, interior and service history. Once the engineer has completed their report they will carry out a series of industry database checks designed to safeguard against fraud. Once these have been successfully completed, payment will be sent to you, subject to the deduction of any excess. Your insurance company will still deal with your claim : their priority should be to get your car repaired, or a settlement to you if it is a total loss (write-off). After this, they will try to recover their outlay from the person responsible for the accident (or their insurance company). If they are successful then making the claim will not affect your No Claims Bonus. This is when it is really important to get statements from independent witnesses, who saw the accident. Plus photos from the scene (but only it is safe to take them). Armed with these, your insurer will do their best to persuade the other driver (or their insurer) that the accident was their fault by presenting them with all the evidence that you have provided us. Your insurer should always fight your corner, but on occasions if the evidence does not fully support either driver’s version of the incident, everybody involved may have to take some responsibility. If this happens your insurer will negotiate the best possible settlement with the other driver/their insurer. If the incident is not your fault and your insurer makes a full recovery from the responsible person, your no claims discount will be unaffected. However if an incident occurs which is not your fault, and they are unable to recover the cost, your no claims discount will be reduced at the renewal of your policy. How much NCD you will lose depends on your insurer, but typically for each incident settled against you, you will lose 2 years No Claims Bonus. So if you started your policy with 5 years No Claims Bonus and had an accident that was your fault, you would still have 3 years No Claims Bonus at the start of the next policy term. If the incident is your fault your no claims discount will be reduced. However, your no claims discount may be protected if you have paid extra. In the event of a theft claim your insurer will probably reduce your no claims discount, as it is highly unlikely they will be able to locate the culprits and recover the costs. Insurers will always prefer you to use one of their Approved Repairers to repair your car. They will argue that their Approved Repairers are carefully scrutinised and appointed to provide the highest customer service and quality of repairs for their customers. They may also throw in other benefits – such as the Approved Repairer will provide you with a free courtesy car for the duration of repairs. And Authorised Repairer repairs will be carried out in accordance with recognised industry standards, guaranteed for 3 years and all replaced parts are manufacturer-approved. Further, Approved Repairers can usually start work more quickly as the need for sending estimates into the insurer to get them approved is removed (the insurers can often see the damage to your vehicle via video technology in the repair shop). But having said that, you do have the choice of using your own repairer. Doing so means though that the insurer can’t guarantee the work and you will need to obtain an estimate for them to approve before work can commence, so it might take longer. And you may lose your right to a courtesy car. If you were not at fault or were only partially at fault for the accident, you may be able to recover some expenses from the person responsible or their insurers. This could include things like your policy excess, hire car costs, taxi costs and accommodation. You will need to keep receipts, as these will be needed to provide evidence of your claim. If you have motoring legal protection (sometimes called motor legal expenses), their claims handlers will negotiate with the other party’s insurer to recover your costs on your behalf and will remain in contact with you during the period of negotiation. It can take up to 6 months to reach agreement with the other party’s insurer. If you don’t have motoring legal protection, you are still entitled to try and claim these costs back from the other party/their insurer, but you will have to do so on your own. This is one of the benefits of the MID that many people are unaware of. If there has been an accident and you need to check the other vehicle is insured, for a fee of £4.50 you can search the Motor Insurance Database (MID) to help determine if the other vehicle is insured. You’ll need the date of the accident and the registration details of the other vehicle. If the registration is found on the MID, you will receive on screen the insurance details: policy number, name of insurer and the claims contact details to help you progress a claim. If you have been recently involved in a Road Traffic Accident (RTA) you can check the insurance details of the other parties involved on the MID (Motor Insurance Database) There are two ways to check if a vehicle is insured after an accident: a one-off askMID search or using the askMID Roadside service. The ‘askMID Roadside’ service is intended for use on a smart mobile device at the side of the road. It allows you to instantly check the Motor Insurance Database (MID) and confirm the insurance details of the other parties involved in an accident. In order to complete the simple askMID Roadside check on a mobile device you need to have the following pieces of information to hand: If you are on a smart mobile device use the askMID Roadside service now. If you are not at the roadside then you can obtain the same information by completing a one-off askMID search. Find out more about completing a one-off search of the database. Here’s a useful checklist of what to do in the event of a car accident : In a bit more detail :

The Essentials

Learner

Car Sharing

Business Use

MID

Claims

The Essentials

Learner

Car Sharing

Business Use

MID

Claims